Senior Living Occupancy Rate Continues Rising as New Supply Remains Limited

October 2, 2025

The information below contains data released by NIC MAP and analyzed by National Investment Center for Seniors Housing & Care (NIC). This news was originally shared by NIC.

Consumer demand for all community types outpaces new construction; Independent Living occupancy surpasses 90%

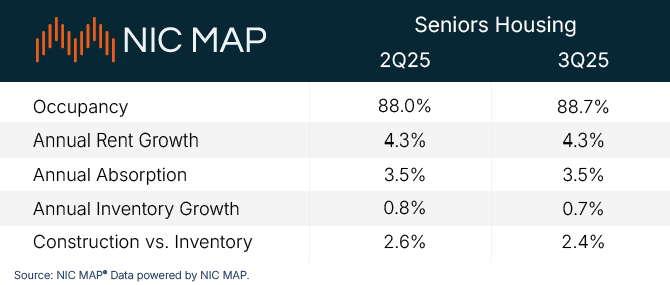

Annapolis, Md (October 2, 2025) – America’s aging population is rapidly transforming senior housing, with occupancy rates climbing quarter after quarter and new supply struggling to catch up. The senior housing occupancy rate in the United States increased 0.7 percentage points to 88.7% in the third quarter of 2025 from 88.0% in the second quarter of 2025, according to the National Investment Center for Seniors Housing & Care (NIC), using data from NIC MAP’s latest quarterly release. This is the seventeenth consecutive quarter of occupancy rate increases.

This trend was seen across community types:

- Independent living occupancy climbed above 90% for the first time since 2019, reaching 90.2%, an increase of 0.5 percentage points from 2Q25. These are communities that primarily serve people who do not yet have ongoing long-term care needs and want to maintain an independent living arrangement.

- Assisted living occupancy jumped to 87.2%, an increase of 0.9 percentage points from 2Q25. This housing serves older adults who need assistance with common daily activities.

- Active adult occupancy stood at 92.1%, edging down 0.2 percentage points from 2Q25, but still well above 90% occupied. These communities are growing in popularity among mostly healthy adults age 55+ who want to live in a community designed for active lifestyles and interaction with peers and who do not yet need or want on-site healthcare services.

Fueled by strong consumer demand from the Baby Boomer generation, which experts say make up 20% of the U.S. population, senior living communities are filling faster than they can be built—highlighting the growing gap between rising occupancy and limited new supply. As younger Boomers transition into senior housing, they seek communities that prioritize health, wellness, and lifestyle—and they’re moving in record numbers. Occupied senior housing units increased from roughly 623,500 in the second quarter of 2025 to nearly 630,000 in the third quarter of 2025.

“Baby Boomers are reshaping the industry by demanding greater choice, whether that relates to lifestyle, services offered, or price point,” said Lisa McCracken, NIC’s head of research and analytics. “The sustained strength across all community types reflects diverse needs. We anticipate strong consumer demand will drive average senior housing occupancy rates above 90% by the end of 2026.”

Experts say economic and market pressures such as the cost of capital, materials, and labor continue to limit supply side growth. Less than 1,400 new units were opened in the third quarter, and inventory growth fell lower than previous quarters, with only 0.7% inventory growth over the prior year. NIC analysts say the combination of high demand and limited construction is driving occupancy as available senior housing communities fill up.

“While we’re beginning to see some movement in the markets, ongoing construction headwinds could lead to a shortage of senior living options in certain areas over the medium term,” said Arick Morton, CEO of NIC MAP. “That’s why it’s important for older adults and their families to start planning now—having conversations early about how and where they want to age ensures they’re prepared when the time comes.”

NIC MAP tracks occupancy rates in 31 primary markets across the country, and all markets are at or well above 85% occupancy. The top five markets each had occupancy rates above 90%, led by Boston (92.6%), San Francisco (90.9%) and Baltimore (90.6%). Meanwhile, Miami (85.3%), Atlanta (85.9%), and Las Vegas (85.9%), were the three markets with the lowest occupancy rates.

A summary of the NIC MAP Market Fundamentals Data is below. An abridged report featuring the newly released data will be available at 4:30 p.m. ET on Thursday, October 2. While the report is a complimentary resource, only NIC MAP clients have exclusive access to the underlying data and additional metrics at the metro level.

About the National Investment Center for Seniors Housing & Care

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. For more information, visit NIC’s website and follow NIC on LinkedIn, and Facebook.

About NIC MAP

NIC MAP believes data drives outcomes. We provide purpose-built data exclusively for senior housing, offering relevant, market-specific insights you won’t find anywhere else, and we’re empowering the senior housing industry to stay nimble and achieve optimal results. Our platform supports robust decision-making with real-time access to occupancy rates, transaction details, and construction project tracking, enabling industry leaders — including the top senior housing operators, largest government agencies and major investors — to navigate market complexities and capitalize on investment opportunities effectively. For more information, visit www.nicmap.com.