Why Are Rents So High for New Communities? Here’s What the Data is Telling Us

Much recent data indicates that the senior housing market is at a critical inflection point. We’ve explored the critical lack of senior housing starts, the anticipated $275B investment opportunity, and the growing supply and demand gap.

Here, we’ll examine another aspect of the market: the staggering rent gap for newly opened communities.

NIC MAP’s data indicates that new communities are charging premium rents, well above market rate. Specifically, in an analysis by NIC MAP of senior housing properties that opened from 2022 through 2024, we found that seven out of every ten senior housing communities debuted with rents above the prevailing market average for their location.

The Rent Gap Between New Properties and Local Market Averages is Immense

While it’s actually typical for most new properties to open above market rent, the surprising part is that they’re opening so far above market rent.

NIC MAP data reveals this rent gap between newly developed senior housing properties and their local market averages.

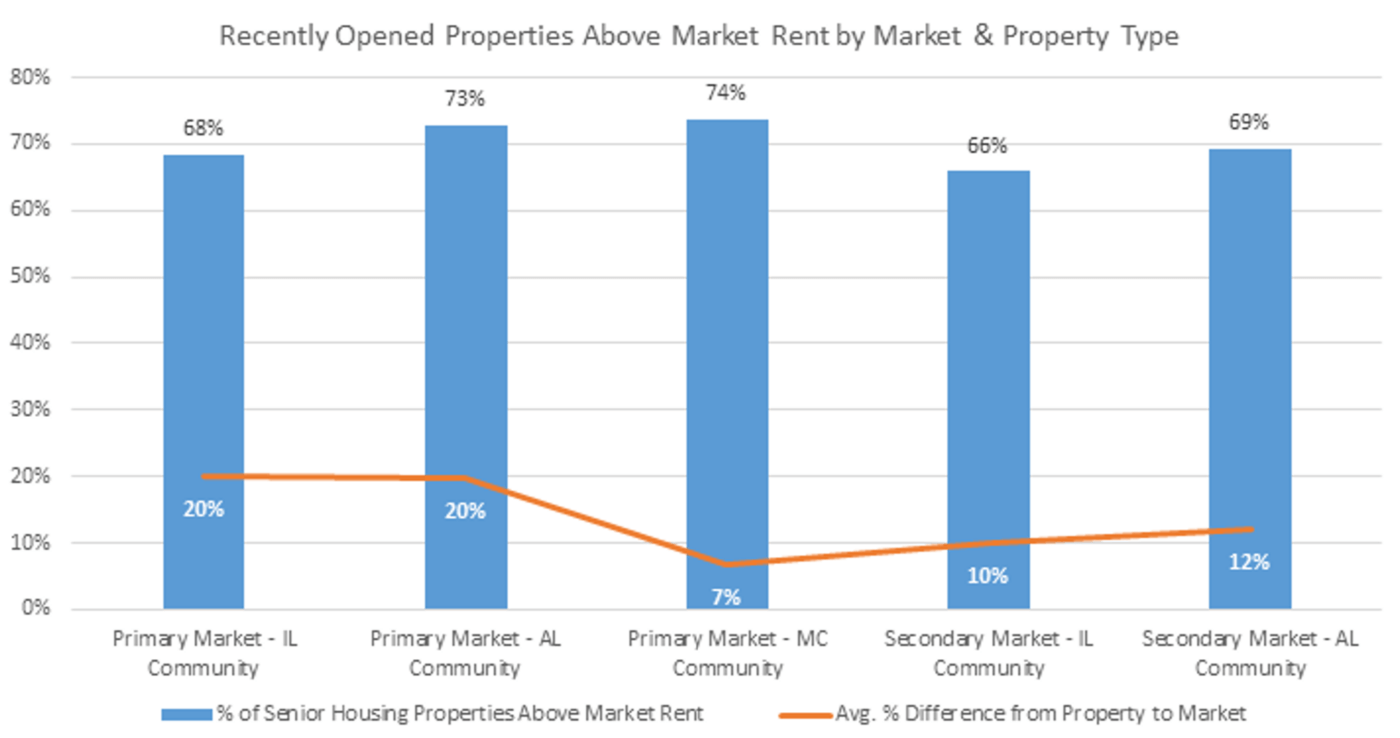

Primary vs. Secondary Market Trends

- Primary Markets (the top 31 metros nationwide): The premium for new communities has been particularly pronounced, with new developments opening at rents 19% above the market.

- Independent Living and Assisted Living entered Primary Markets at a 20% premium over market rents.

- Secondary Markets (markets 32 through 99 nationwide): These areas have seen a more modest 11% gap.

- Assisted Living properties exhibit a slightly higher premium than Independent Living, at 12% versus 10%.

If we isolate the majority of properties that open above market rent, we see that the average rent delta increased to about 30% for both majority Independent Living and Assisted Living.

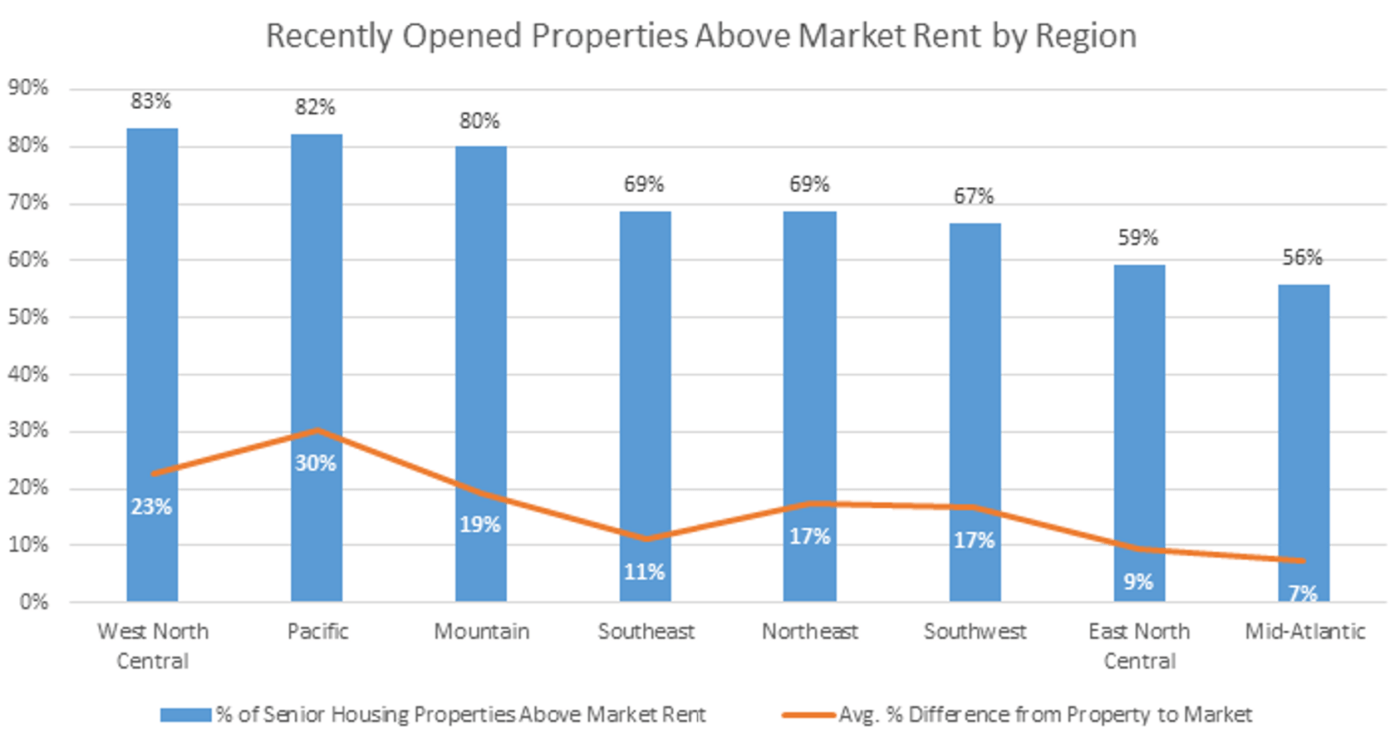

Regional differences add another layer of complexity to the story.

- In the Pacific region, more than 80% of new senior housing properties opened with rents above market averages, with an average rent gap of 30%.

- By comparison, in the Mid-Atlantic region, just over half of new properties commanded a rent premium, with a much smaller average rent delta of only 7%.

These numbers paint a picture of a market where location plays a major role in feasibility.

One of the more interesting trends emerging from this data is the recent gradual narrowing of the rent premium. In 2022, newly opened communities charged, on average, 20% above market rents. That figure declined to 17% for properties that opened in 2023 and dropped further to 10% for 2024 openings. This shift suggests either that developers are adjusting pricing strategies to better align with consumer demand or that market rents are catching up, helping to close the divide.

What is Causing the Rent Gap?

The financial realities of developing senior housing have become increasingly challenging, and one of the clearest indicators of this pressure is premium rents.

Development costs have increased significantly due to rising labor and material expenses, higher interest rates, and tighter capital markets. In many cases, the financing required for new projects has simply become too expensive, forcing developers to target a high-end consumer who can pay the necessary rents to justify construction. At the same time, middle-market projects have become harder to execute, resulting in fewer new developments aimed at this demographic.

This reality also underscores why construction starts have slowed, as developers struggle to make projects financially viable.

What Does This Mean for the Senior Housing Industry?

Implications for investors, developers, and operators are layered. The environment is challenging, but it’s also full of opportunity for those who can adapt their strategies accordingly. Here’s what we’re seeing:

The emergence of a two-tiered market. Newly built properties are catering to a clientele who can afford the necessary rents for construction, and established communities are more solidly the primary option for middle-market consumers.

Reinvestment in existing properties. This dynamic may drive reinvestment in existing properties, as owners recognize the opportunity to renovate and reposition older assets rather than attempt costly new construction. We’re starting to see this proven by the data: Acquisitions activity in the market is picking up year over year.

Signs of market normalization. The narrowing rent gap for newly developed properties is encouraging. It could signal the beginning of a market normalization. If this trend continues, it may indicate a more balanced environment in the years ahead, where development costs and achievable rents are more aligned.

Possible stagnation. However, if financing remains tight and construction costs do not ease, new development will remain stagnant until economic conditions improve. In this case, we may see a prolonged period of supply constraints, which could drive rent growth in existing properties as industry-wide occupancy climbs. The data shows early signs of this possibility: Absorption is up 26% year over year (Q1 2025 versus Q1 2024), and occupancies are increasing at a fast clip.

As these trends continue to evolve, it’s more important than ever to have up-to-date insights to guide your strategic decision-making. Learn what NIC MAP can do for you.

Why the Industry Needs to Bridge This Gap

The findings from NIC MAP underscore a critical reality: the cost of building new senior housing is outpacing market rents, simultaneously creating a supply constraint but also a product and rent bifurcation.

While high-rent developments continue to push forward, the broader industry must grapple with the question of how to serve a growing aging population without pricing out a significant portion of potential residents. Whether through innovation, policy shifts, or economic changes, the future of senior housing will depend on the industry’s ability to bridge this gap.

Want to go deeper? Download the NIC MAP Senior Housing Outlook Report. You’ll find comprehensive insights into these conflicting market dynamics as well as investment opportunities.