The NIC Growth Conference 2025: How Operators are using our data to make better business decisions

Senior housing operators, investors, and developers gathered at the 2025 NIC Growth Conference to explore one big question: how can the industry rise to meet unprecedented demand from America’s aging population? Backed by robust data, expert panels, and a new market intelligence tool, the conference provided a compelling roadmap for those ready to seize the moment.

Unique and insightful perspectives were shared by an expert panel consisting of Andy McDonald, Chief Financial Officer for HumanGood, Kinsey Spraggins, Corporate Director of Revenue for Sagora Senior Living and Dennis Murphy, Chief Investment Officer for Priority Life Care. While optimism was the mood of the day, the panelists didn’t shy away from discussing the industry’s headwinds.

Here’s a recap of the key takeaways:

Demographics Driving Durable Demand:

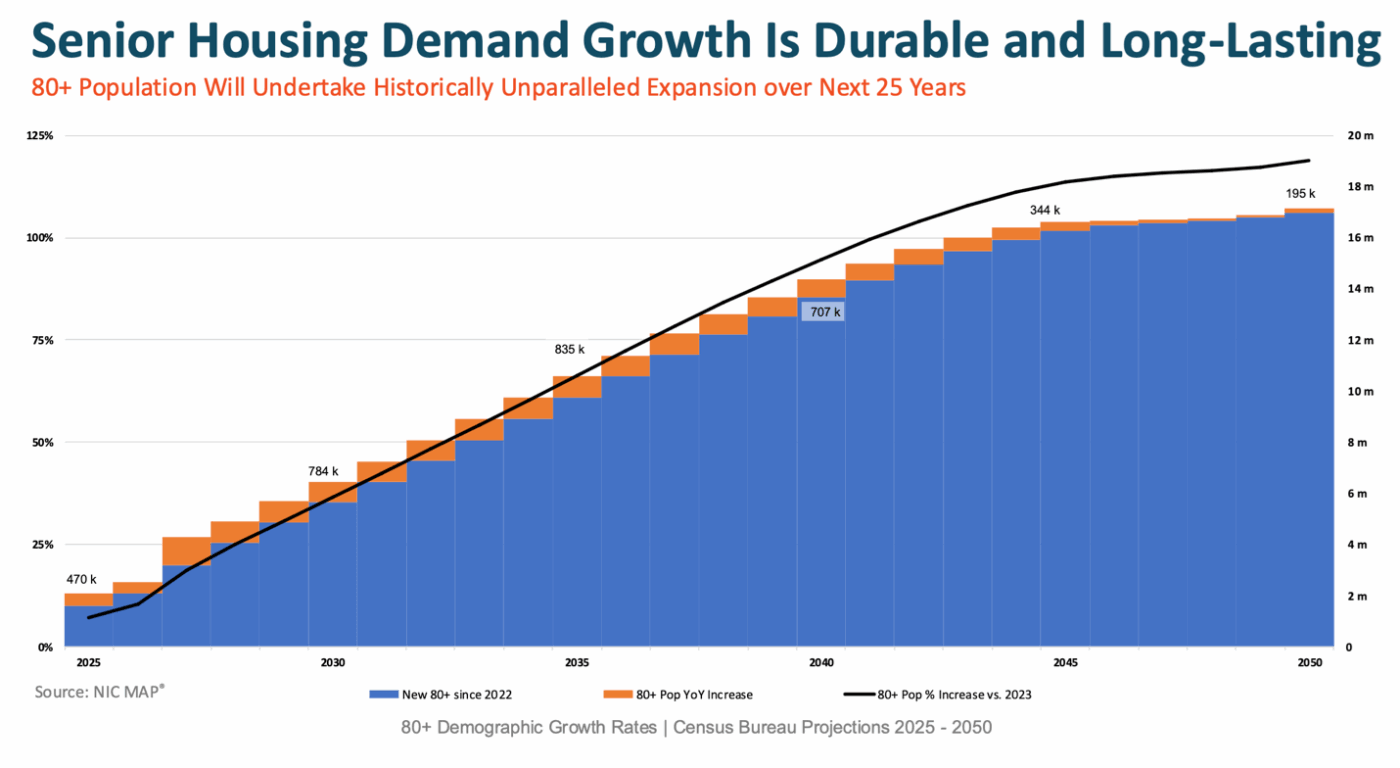

The NIC MAP data shared by CEO Arick Morton painted an interesting picture: the 80+ population in the U.S. is poised for historic growth over the next 25 years. According to Census Bureau projections, between now and 2050, the number of people over age 80 will expand by nearly 125%. This aging wave represents a massive, durable, long-term driver of demand for senior housing.

The graph shows the annual increase in the 80+ population, climbing from roughly 470,000 in 2025 to over 830,000 annually by 2035 fueling demand for senior living communities that simply doesn’t exist today.

But the message wasn’t just about opportunity, it was about urgency. To keep up with demand, the senior living industry will need more than $1 trillion in new development by 2041 to avoid an increasingly dramatic undersupply of units and unmet consumer needs.

Occupancy Recovery and Tight Inventory

Another key trend: occupancy rates are rebounding after the pandemic-era lows. NIC MAP data revealed that assisted living (AL) and independent living (IL) properties in primary markets are seeing strong momentum, with occupancy tracking toward or above 90% through 2025.

Occupancy rates for AL, IL, and memory care are not just recovering, they’re stabilizing at or above pre-pandemic levels. For example, assisted living occupancy has jumped from lows in the mid-80% range back above 90%, indicating both strong consumer confidence and tightening supply.

Despite this positive trend, annual inventory growth has lagged. Assisted living shows slight increases, but independent living inventory growth has declined. This imbalance creates a supply-constrained environment a double-edged sword that offers short-term pricing power for operators but signals long-term risk if development pipelines don’t accelerate.

Capital Market Trends: Rising Values

From a capital markets perspective, NIC MAP shared the latest data on pricing trends: the rolling four-quarter price per unit (PPU) for senior housing has reached $145,000, with nursing care units averaging $77,000.

This upward trend in transaction pricing reflects the sector’s resilience and the growing appeal of senior housing assets. As capital pours back into the market, investors are showing renewed appetite, particularly for properties with strong operating fundamentals in high-barrier-to-entry markets.

“I really learned that for data to be effective, it has to be persuasive. It has to be something that you can walk with. The story is obvious from the visualization.” Andy McDonald – Chief Financial Officer, HumanGood

A Call to Action for Operators, Developers, and Investors

The message was clear at the NIC Growth Conference with a unified call to action: the time to act is now. With a demographic boom incoming, the senior housing sector must mobilize capital, scale development, and innovate on operations.

At the current pace, the investment gap to meet 90% occupancy levels will exceed $1 trillion by 2041. Without a step-change in development activity, this gap will only widen, leaving millions of seniors without appropriate housing and care.

“Before, we weren’t making any grounds really on occupancy. Now all our dashboards update every two hours. That has been a huge game changer.… I just wish we would have partnered with NIC MAP sooner. It has really made such a huge difference in how we operate at both the community and corporate level.” – Kinsey Spraggins – Corporate Director of Revenue, Sagora Senior Living

Expert Panel: Labor, Costs, and Competition

Our expert panel of leaders from across the senior living industry weighed in on how NIC MAP data and tools are instrumental in making community level decisions.

Labor shortages continue to challenge operators, making it essential to understand wage trends, job demand, and recruitment patterns. NIC MAP’s new labor data helps operators benchmark wages by region and role.

Kinsey Spraggins shared the Sagora Senior Living dashboard within the NIC MAP platform revealing that they have made great gains in reducing overtime.

Dennis Murphy discussed how NIC MAP data provides the means to properly analyze existing and future competition in the markets, as well as leveraging the data to find clarity into senior housing wage rates and job demand.

Competition is heating up in certain markets. Even as there’s a national undersupply, local markets can become overbuilt making it critical to analyze supply pipelines and demographic density before launching new projects.

Andy McDonald shared how HumanGood leveraged NIC MAP data to help their board visualize the strategic pivot that was taking place and leverage the data to take action.

The panel also talked about the value of NIC MAP’s financial benchmarking tool which allows operators to compare anonymized, standardized income statement data across properties, helping uncover operational inefficiencies and revenue opportunities.

The senior housing market stands at the edge of historic opportunity. But capturing that opportunity requires data, speed, and smart investment today. As Arick Morton put it: “The demographic trends are on our side. The question is: are we ready?”