Beyond Secret Shops: Why It’s Time for a Smarter, More Complete View of Your Market

Operators and capital partners have relied on secret shops for years and for good reason. Understanding competitor pricing, service offerings, and positioning has long been a cornerstone of strategic market awareness.

While traditional shops provide valuable snapshots, they leave teams to connect the dots themselves often without a full view of occupancy trends, market performance, or emerging risks.

What’s missing isn’t just more data. It’s faster access to real insights and a broader understanding of what’s happening within the local market.

It’s not about replacing what works.

It’s about building on it and getting more from the effort you’re already making.

Where Traditional Market Shops Fall Short

Most traditional market studies still play a critical role. They capture important details: base rates, care fees, incentives, unit configurations, even self-reported occupancy.

But even the best shops have inherent limits:

- Occupancy data is typically self-reported, making it harder to trust building performance metrics.

- Data provides a snapshot but not a trendline.

- Analysis is manual, requiring operators or capital partners to interpret findings and find patterns on their own.

- Scope is narrow, often focused solely on building-level factors without connecting to broader market dynamics like pipeline activity, local demographics or demand.

Traditional shops give you pieces of the story.

But the next iteration is a complete, decision-ready view.

What Insight-First Market Intelligence Looks Like

An insight-first approach doesn’t abandon the value of traditional shops – it enhances them.

- Pricing data is still gathered using traditional market shop techniques.

- Occupancy rates are verified and aggregated through operator-sourced reporting, providing a more accurate reflection of fill rates and performance.

- Key risks and gaps are highlighted automatically, noting areas like pricing deltas, emerging competitive threats, and areas of opportunity.

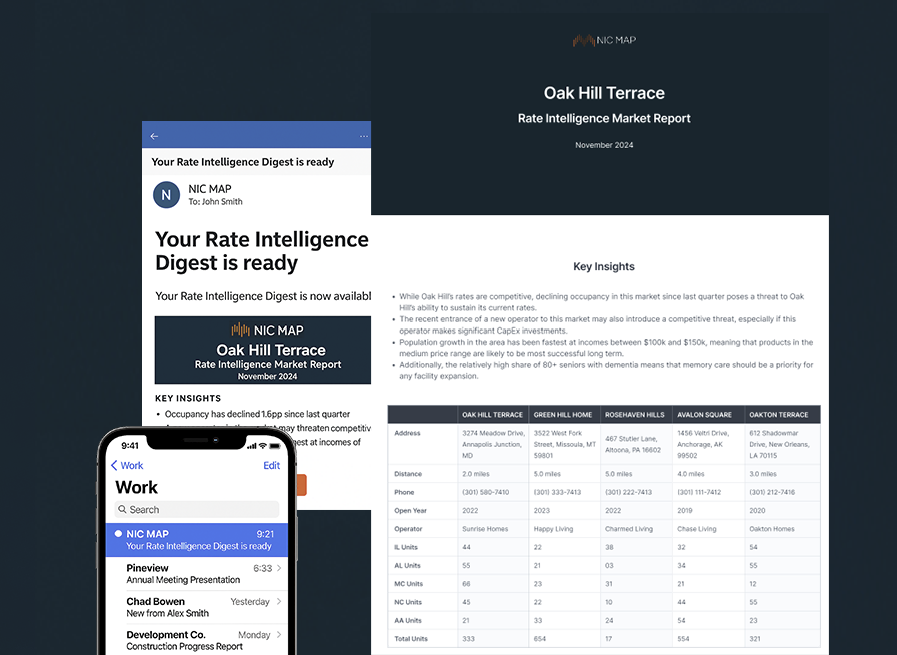

- Digest-style delivery means no extra work—no login, no spreadsheet interpretation, no building director follow-up required.

Instead of adding more data to manage, insight-first intelligence delivers what matters most already surfaced and ready to act on.

Building on the Familiar, Not Replacing It

If you’ve been relying on traditional shops, you don’t have to rethink your approach – you just need tools that deliver deeper insights and enable faster decisions.

Rate Intelligence was designed to bridge the gap between traditional shop methodologies and modern decision-making needs:

- Same attention to pricing detail.

- Deeper occupancy validation.

- Built-in trend and gap analysis.

- Easy, email-based access across your team.

You still get what you need delivered faster, backed by more reliable data, and in a format that’s built for action.

See How Insight-First Market Intelligence Changes the Game

Rather than leveraging secret shops alone to guide your local market strategy, it’s time to take the next step.

Request a sample digest today and see how Rate Intelligence compares to your current shop approach – faster insights, broader context, clearer market positioning.